PROBABLY TOMORROW

If prediction markets are new, here is the simple version.

People put money on what they think will happen.

The price is the crowd’s real opinion.

Spikes mean something shifted. Drops mean confidence faded. Wild swings mean no one has a clue.

We watch those moves and translate them into normal language.

Some Fridays bring clarity.

This one brought an explosion of confusion, a geopolitical warning light, and a cultural facepalm so pure that only prediction markets could capture it.

Let’s get into what moved. ↴

GEOPOLITICS

🌎 Chile just flipped the table

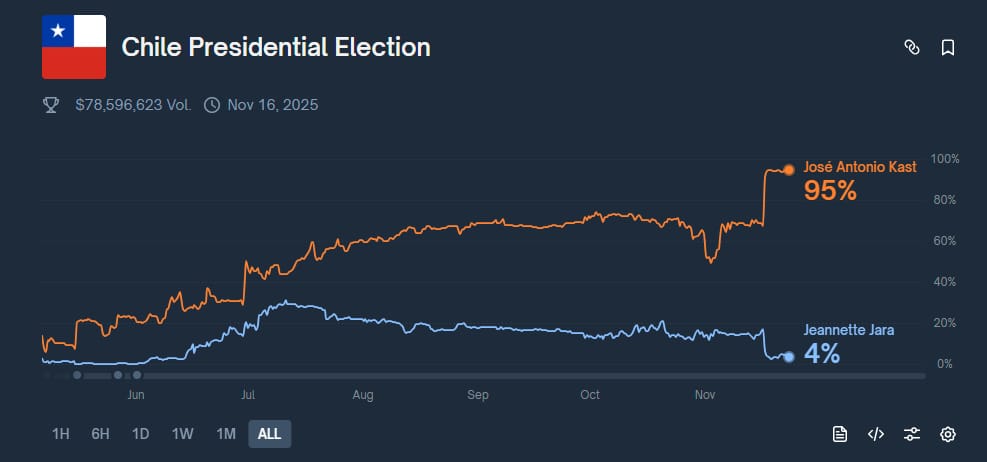

Chile presidential election market - Screenshot from Polymarket

Chile’s election map did not move.

It detonated.

José Antonio Kast is sitting at roughly ninety five percent. That is the kind of number where the market is not debating the outcome anymore. It is calculating the margin of victory.

All the signals lined up.

Side markets converged.

Volume piled in fast.

The whole cluster behaved like someone hit “sync” and the chart obeyed.

Chile is usually predictable. When it stops being predictable, markets pay attention. Foreign investors watch Chile the way surfers watch a wave. When it curls the wrong direction, everyone takes notice.

And that is what happened here.

A right-leaning surge strong enough to pull all the probabilities into the same direction at once.

“Simple version:

Chile blinked, the market reacted instantly, and the political center of the Andes just shifted a few centimeters.”

ADS??

By the way

If you want to try prediction markets yourself, Polymarket is the easiest place to start.

If you deposit 50 dollars and take a position, we get a small kickback.

It keeps this whole project running.

None of this is investment advice.

Have fun, stay curious, do not bet the rent.

Our Polymarket link: Tap here

ECONOMICS

The Fed is trying to whisper, the market is trying to shout

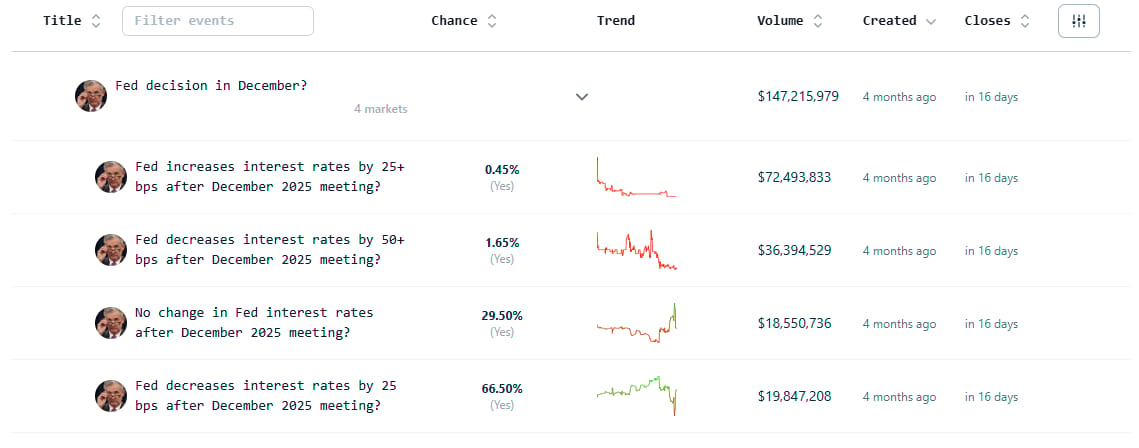

Screenshot from Nevua.Markets

The December rate decision is turning into a tug of war.

The 25bp cut camp regained control.

The “no change” crowd still refuses to leave.

And every minor speech, leak, or inflation tick is treated like gospel.

You can almost hear the mental gymnastics.

One side is saying “inflation cooling.”

The other is saying “not cooling fast enough.”

And the chart is just wobbling in sympathy.

The fun part is that this is not a macro debate.

This is mood.

The market is reacting to tone, not numbers.

This is the kind of environment where a single sentence from a Fed official can swing a probability bar harder than two months of data.

If December ends with a 25bp cut, no one will be shocked.

If it ends with nothing, no one will be shocked either.

What matters is the wobble itself.

People forget this:

Uncertainty is a trade.

And right now the Fed is generating a lot of it

US POLITICS

The Trump - Mamdani Friday plot twist

Here is where things get delightful.

Polymarket opened a market asking if ZOHRAN MAMDANI would praise DONALD TRUMP on Friday.

This was already absurd enough.

Then Friday happened.

Then the internet happened.

Then the interpretations happened.

Then the clips happened.

Then the counter clips happened.

Then the arguments about what counts as praise happened.

Then the market got CONTESTED.

Imagine building an oracle system for global forecasting and ending up in a philosophical debate about whether “he said something nice but also sarcastic but also maybe not but also maybe yes” qualifies as praise.

Only prediction markets can do this.

This is the best kind of chaos.

The crowd trying to decipher tone.

The traders trying to litigate semantics.

And the market admins probably praying that no one ever asks them to define “praise” again.

The whole thing feels like a group project where no one read the instructions and half the class insists their interpretation is the real one.

It is stupid.

It is glorious.

It is exactly why the fun markets matter.

They expose how fragile certainty actually is.

THE END?

The bigger picture

Chile’s explosion shows how markets process political shocks.

The Fed wobble shows how markets process mood.

And the Trump–Mamdani meltdown shows how markets process chaos.

Three different stories.

Same underlying theme.

Prediction markets are not about proving who is right.

They are about revealing how people think.

Some days that means geopolitics.

Some days that means interest rates.

Some days that means crowds trying to legally define “praise.”

This is the world now.

Data, emotion, culture, all updating in real time.

And we are just getting started.

Today proved one thing. When the world gets noisy, the probabilities update before the headlines do.

We will be here tomorrow. Probably.

Follow us…After the end!

If you like watching the world update its beliefs in real time, we do it in more places.

X is where we yell into the void.

Instagram is where we pretend to be visual people.

TikTok is where we test how long it takes before the algorithm gets confused.

X ( a.k.a: Twitter ) : Click and follow

Instagram: Come have fun and Follow

Today proved one thing. When the world gets noisy, the probabilities update before the headlines do.

We will be here tomorrow. Probably.

See you next,

Probably Tomorrow

Probably tomorrow icon